UAE Digital Assets Startup Fuze Gets $12.2 Million in New Funding Round

Fuze, a company in the UAE that builds digital asset systems, has raised $12.2 million in a Series A funding round. This brings its total funding to $20 million, as more people are getting interested in the crypto market.

Recent Funding Round

Fuze recently raised new funds from investors. The round was led by Galaxy, a digital assets and data center company based in New York, and e& capital, the investment arm of the technology group e&. A few other investors also joined in.

This funding will help Fuze grow in the region and internationally, improve its products and compliance, and hire top talent.

About Fuze

Fuze was started in 2023 by Mohammed Ali Yusuf, Arpit Mehta, and Srijan Shetty. All three were featured in the Forbes Middle East 30 Under 30 list in 2023.

Fuze offers Digital Assets-as-a-Service (DAaaS), which helps banks, payment companies, fintechs, and other businesses in MENA and Türkiye offer digital assets in a legal and secure way. It also runs an over-the-counter (OTC) trading desk for large digital asset trades.

Fuze has also launched stablecoin products and recently expanded into digital payments with a product called FuzePay.

Growing Interest in Crypto

Interest from traditional businesses is growing fast. Many are looking for legal and scalable ways to get into crypto, said Mo Ali Yusuf, Fuze’s CEO and co-founder, in an interview with Forbes Middle East.

He believes that within a year, most financial companies will use some form of crypto or stablecoin.

Because of this rising demand, Fuze is growing quickly and offering more products, including tools for wealth management, stablecoins, and digital payments.

So far, Fuze has over 300 institutional clients, has processed more than $2.2 billion in transactions, and has become profitable in the past year.

e&’s Strategy

Telecom companies are starting to see how important digital asset infrastructure is. That’s why e& invested in Fuze. It fits into e&’s wider plan to grow in fintech.

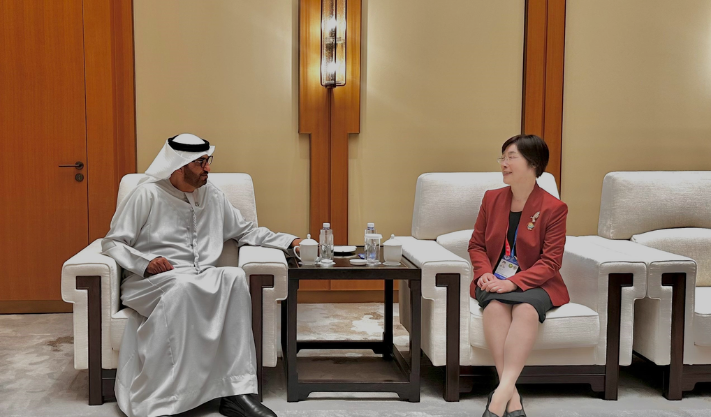

“There’s a natural fit between Fuze and our fintech brands like e& money, Wio, and Careem Pay,” said Harrison Lung, Chief Strategy Officer at e&. “We want to support strong companies building the future of financial services with digital assets.”

Fuze and e& will work together to build safe and scalable digital asset products. Yusuf said this partnership is part of e&’s digital strategy and could change how telecoms and fintech work together in the digital asset space.

Market Opportunity

According to Chainalysis, a blockchain data firm, the Middle East and North Africa (MENA) region was the seventh-largest crypto market in the world in 2024. Between July 2023 and June 2024, MENA received $338.7 billion in on-chain crypto value—about 7.5% of global volume.

Yusuf said the UAE is Fuze’s main base and an important market, thanks to its clear regulations and role as a financial link between Asia, Europe, and Africa.

Fuze is also seeing strong interest in the GCC, Türkiye, and CIS regions. Yusuf said the Middle East is becoming more active in digital assets, with a lot of trading happening within the region.

He also said that many of their competitors are either global companies with no local presence or unlicensed firms. “Trust and compliance will set us apart,” he said. “We’re from this region, and we’ve built our systems to fit local needs—something only locals truly understand.”

In April, Hub71 in Abu Dhabi shared that startups in its Digital Assets program have raised over $100 million. Partnerships with major tech companies like Google, NVIDIA, Solana, Hashed, and AWS are also driving innovation in areas like Web3, AI, clean energy, and advanced technology.

Published: 1st May 2025

For more article like this please follow our social media Twitter, Linkedin & Instagram

Also Read:

Saudi banks lent $100B in 2024; risks remain controlled

e& UAE profit doubles to $1.5B in 2025 on higher revenue

FAB Q1 2025 profit jumps 23% to $1.4B on global growth