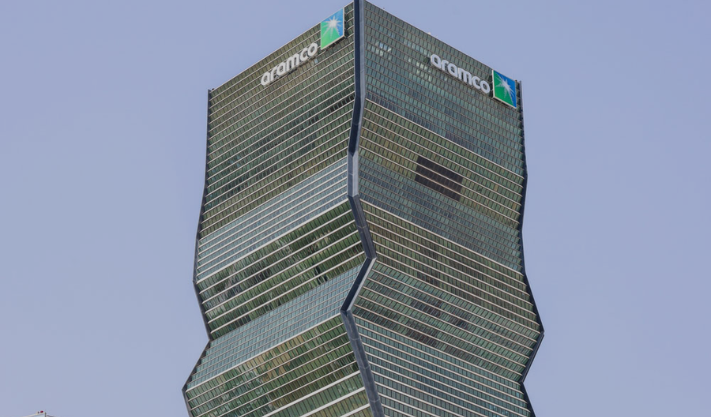

Saudi Aramco Raises $5 Billion in First Dollar Bond Sale of 2025, Split Into Three Parts

Saudi Aramco said on Monday that it has raised $5 billion by selling bonds in three parts as part of its global note program. This is the company’s first bond sale in US dollars for 2025.

Aramco’s Bond Sale

Aramco, the state-owned energy company, said it has issued several bonds. The longest one is worth $2.2 billion and will be paid back in 2055. It offers a 6.375% yearly interest rate.

Other bonds include:

-

$1.5 billion maturing in 2030 with a 4.75% interest rate.

-

$1.25 billion maturing in 2035 with a 5.375% interest rate.

The bonds were priced on May 27 and are listed on the London Stock Exchange.

All parts of the bond sale were priced without any extra costs for new issuance. Many big investors were interested in buying them.

Ziad T. Al-Murshed, Aramco’s finance head, said strong investor interest shows that global investors trust Aramco’s financial strength.

First Quarter (Q1) 2025 Results

In the first quarter of 2025, Aramco made $108.1 billion in revenue—a small 1% increase compared to the same time last year. This was due to selling more gas and chemical products, although lower prices reduced the overall gain.

However, net profit fell by 4.6% to $25.9 billion. This was mainly due to weaker prices, lower sales income (down to $6.4 billion), and higher costs.

CEO Amin Nasser said global economic uncertainty and unstable energy markets affected the results. Still, he noted progress in areas like gas, petrochemicals, blue hydrogen, and carbon capture.

Recent Deals

Last month, Aramco signed 34 deals with major U.S. companies, worth a total of $90 billion. These deals aim to support Aramco’s growth in oil, gas, artificial intelligence, and manufacturing.

Some key agreements:

-

With Honeywell to use its technology in an aromatics project.

-

With Motiva for a similar project in Port Arthur.

-

With Afton Chemical to develop fuel additives.

-

With ExxonMobil to expand the SAMREF refinery into a petrochemical complex.

Aramco also signed a 20-year deal with NextDecade to buy 1.2 million tons of LNG (liquefied natural gas) each year from the Rio Grande LNG facility.

Published: 4th June 2025

For more article like this please follow our social media Twitter, Linkedin & Instagram

Also Read:

Egypt’s Non-Oil Private Sector Nearly Stable in May

$1T Middle East Wealth Shift by 2030—Can Tech Help?

Emirates Chief Blames Plane Makers for Delivery Delays