Bahrain’s Al Salam Bank launches new asset management company, ASB Capital, managing $4.5 billion in assets

Bahrain’s Al Salam Bank announced on Monday that it will soon open a new asset management company called ASB Capital. The company will be based in the Dubai International Financial Center and will manage $4.5 billion in assets.

Asset Management Firm

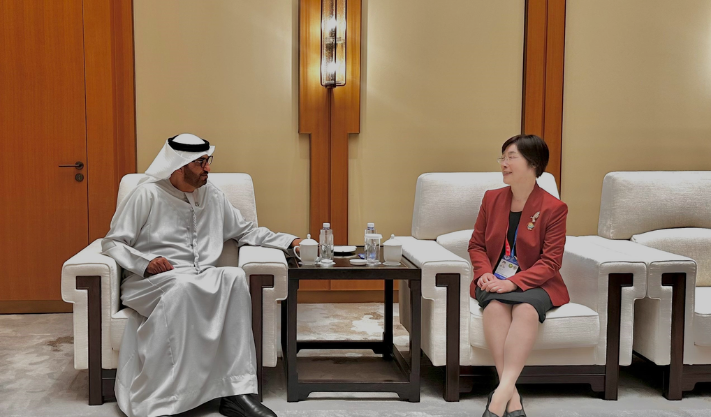

The announcement was made during the Gateway Gulf Investment Forum (GGIF) in Bahrain on November 3 and 4.

ASB Capital will offer investment solutions to wealthy individuals, family offices, companies, and large clients across the Middle East and Africa (MEA) and beyond. The firm will focus on four main areas: public markets, private markets, investment banking, and placements.

ASB Capital is licensed by the Dubai Financial Services Authority (DFSA). The firm will give the bank access to special investment opportunities for large investors through products that use advanced financial technology.

ASB Capital will provide private market products like private equity, venture capital, and real estate, meeting the increasing demand for specialized asset management and advice in the region.

After its launch, ASB Capital aims to keep growing its assets to become one of the top 10 asset managers in the area, according to Al Salam Bank.

“ASB Capital is set up to expand Al Salam Bank’s operations, create new income sources, and support regional growth,” said Rafik Nayed, Group CEO of Al Salam Bank and managing director of ASB Capital.

ETF Market

ASB Capital plans to enter the Exchange Traded Fund (ETF) market by offering simple investment products. Al Salam Bank mentioned they are working with a major global ETF company, but didn’t name them.

Financial Results

Al Salam Bank reported a 39% increase in net profit for its shareholders, reaching $37.9 million (BD 14.3 million) in the second quarter of 2024. This growth came mainly from core banking services, with total income for the quarter at $249.9 million (BD 94.2 million), an increase of 37.5%.

For the first half of the year, ending June 30, the bank’s net profit for shareholders was $75 million (BD 28.3 million), up 37.6% from last year.

Published: 5th November 2024

For more article like this please follow our social media Twitter, Linkedin & Instagram

Also Read:

Saudi Arabia’s SFD signs an agreement with Asia’s AIIB to work together on solving global development challenges

Saudi Arabia Opens Luxury Travel Destination Sindalah

Lulu Retail sets IPO price range to raise up to $1.4 billion