Top 10 Listed Companies in Saudi Arabia 2025

As of April 25, 2025, the top 10 companies listed in Saudi Arabia had a total market value of $2.1 trillion. In 2024, they made a combined profit of $133.9 billion.

Banks are the most common in the list, taking 5 of the 10 spots. These top companies come from major sectors like energy, banking, telecom, industry, and utilities.

How We Ranked Them

We used data from the Saudi Stock Exchange (Tadawul) and ranked companies based on their 2024 sales, profits, assets, and market value as of April 2025. Each factor had the same importance. Companies with equal scores were given the same rank.

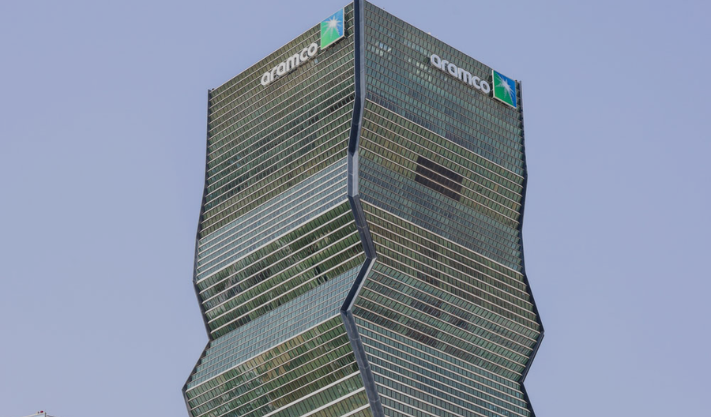

1. Saudi Aramco

-

Sector: Energy

-

CEO: Amin H. Nasser

-

Market Value: $1.7 trillion

-

Sales: $480.4 billion

-

Profit: $106.2 billion

-

Assets: $646.3 billion

Saudi Aramco is the biggest energy and chemicals company in the world. In 2024, it raised $12.35 billion by selling 1.7 billion shares and signed over $25 billion in contracts for its gas projects. It also started building a refinery in China with Sinopec and FPCL. In 2025, it signed $90 billion worth of deals with U.S. companies.

2. Saudi National Bank (SNB)

-

Sector: Banking

-

CEO: Tareq Al Sadhan

-

Market Value: $57.3 billion

-

Sales: $18.7 billion

-

Profit: $5.6 billion

-

Assets: $294.4 billion

SNB, formed by merging NCB and Samba in 2021, has 478 branches and operates in several countries including the UAE, Bahrain, and Turkey. In 2024, it served 14.4 million customers and issued a $500 million bond in Taiwan.

3. alrajhi bank

-

Sector: Banking

-

CEO: Waleed Al-Mogbel

-

Market Value: $104.7 billion

-

Sales: $16.1 billion

-

Profit: $5.3 billion

-

Assets: $259.8 billion

alrajhi bank had record earnings in 2024. It bought 65% of a local finance app called Drahim and served 18.5 million customers. In early 2025, it signed a $666.7 million finance deal and issued a $1.5 billion sukuk (Islamic bond).

4. stc Group

-

Sector: Telecom

-

CEO: Olayan Alwetaid

-

Market Value: $64 billion

-

Sales: $20.2 billion

-

Profit: $6.6 billion

-

Assets: $42.8 billion

stc Group, mostly owned by Saudi Arabia’s PIF, has nearly 29 million mobile and 5.9 million fixed-line users. In 2025, it launched STC Bank and signed a telecom contract worth $8.7 billion. It also restructured its tower business, now partly owned by PIF.

5. SABIC

-

Sector: Chemicals/Industrials

-

CEO: Abdulrahman Al-Fageeh

-

Market Value: $49.6 billion

-

Sales: $37.3 billion

-

Profit: $993 million

-

Assets: $74.1 billion

SABIC makes chemicals and operates in 43 countries. It bounced back from a loss in 2023 to nearly $1 billion profit in 2024. It sold its 20.62% stake in Aluminum Bahrain to Maaden. Since 2020, Aramco owns 70% of SABIC.

6. Saudi Electricity Company (SEC)

-

Industry: Utilities

-

CEO (Acting): Khalid bin Salim AlGhamdi

-

Market Value: $16.8 billion

-

Revenue: $23.6 billion

-

Profit: $1.8 billion

-

Assets: $145.9 billion

In 2024, SEC added more customers, growing by 2.7% to 11.3 million. Electricity production also rose by 7.5%, reaching 236.4 terawatt-hours. In February 2025, SEC signed a deal to buy power from a $3.6 billion gas power plant project called Qurayyah IPP Expansion. That same month, SEC raised $2.75 billion by issuing sukuk (Islamic bonds) listed on the London Stock Exchange. The company also paid $1.5 billion of old debts to the government. The Public Investment Fund (PIF) owns 74.3% of SEC, while Saudi Aramco owns 6.9%.

7. Riyad Bank

-

Industry: Banking & Financial Services

-

CEO: Nadir S Al-Koraya

-

Market Value: $25 billion

-

Revenue: $8 billion

-

Profit: $2.5 billion

-

Assets: $120.1 billion

Founded in 1957, Riyad Bank runs 333 branches in Saudi Arabia and has offices in London, Houston, and Singapore. In 2024, its profit rose by 15.9% to $2.5 billion, and total assets grew by 16.42%. In late 2024, the bank raised $750 million through a sustainable sukuk. In early 2025, it issued another sukuk worth $533.3 million.

8. Saudi Awwal Bank (SAB)

-

Industry: Banking & Financial Services

-

CEO: Tony Cripps

-

Market Value: $19.4 billion

-

Revenue: $7 billion

-

Profit: $2.2 billion

-

Assets: $106.5 billion

SAB started in 1978 as the Saudi British Bank. It merged with Alawwal Bank in 2019 and was renamed in 2023. The bank has 101 branches and over 4,000 employees. In December 2024, it raised $1.1 billion through a sukuk. Its profit rose by over 15% in 2024.

9. Saudi Arabian Mining Company (Maaden)

-

Industry: Industrial (Mining & Metals)

-

CEO: Bob Wilt

-

Market Value: $47.7 billion

-

Revenue: $8.7 billion

-

Profit: $1.1 billion

-

Assets: $30.7 billion

Maaden is the largest mining company in the Middle East and supplies 20% of Saudi Arabia’s non-oil exports. In February 2025, it bought SABIC’s 20.62% share in Aluminium Bahrain (Alba) for $966.3 million. It also issued its first global sukuk worth $1.25 billion. The Public Investment Fund owns 65.2% of the company.

10. Alinma Bank

-

Industry: Banking & Financial Services

-

CEO: Abdullah Ali Al Khalifa

-

Market Value: $20 billion

-

Revenue: $5.3 billion

-

Profit: $1.6 billion

-

Assets: $73.8 billion

Founded in 2006, Alinma Bank offers Islamic banking services. By March 2025, it served 5.8 million customers. In October 2024, it provided $756 million in financing to Bahri for buying nine oil tankers. Its profit increased by 20.5% in 2024. In April 2025, the bank signed a $200 million loan deal with ACWA Power and launched a Freelance Card in partnership with the Social Development Bank.

Published: 7th July 2025

For more article like this please follow our social media Twitter, Linkedin & Instagram

Also Read:

Mubadala vs PIF: Two Giants Reshaping National Economies

Modon Sells $1.5B Wadeem Plots on Hudayriyat in 3 Days

IMF Extends Time for Egypt Reforms, Loan May Be Delayed